Popular Generic and Branded Drugs

How Much Money Is Spent on Drugs in the US?

The USA is the country that consumes the most drugs per capita in the world. This is directly reflected in the figures showing population spending on medicines, since medicines in the US are traditionally expensive. So, in 2019, Americans shelled out a record $511 billion from their pockets. The already usually high amount has become a record in no small part due to the coronavirus pandemic, which not only forced people to purchase various medicines for the treatment of COVID-19, but also turn their attention to numerous preventive agents, drugs to increase immunity, vitamin and mineral complexes etc. It should be noted that at the same time, the pharmaceutical market receives about 80% of the profit from branded drugs, which in the vast majority of cases are significantly more expensive than generics (analogues).

Medicines can be divided into several categories according to different classification principles. The most common method of classifying drugs is to group them according to what they are used for (against which diseases). For example, consider drugs for diabetes. Americans spent about $67 billion on them in 2019, making them the second most sold pharmaceutical category.

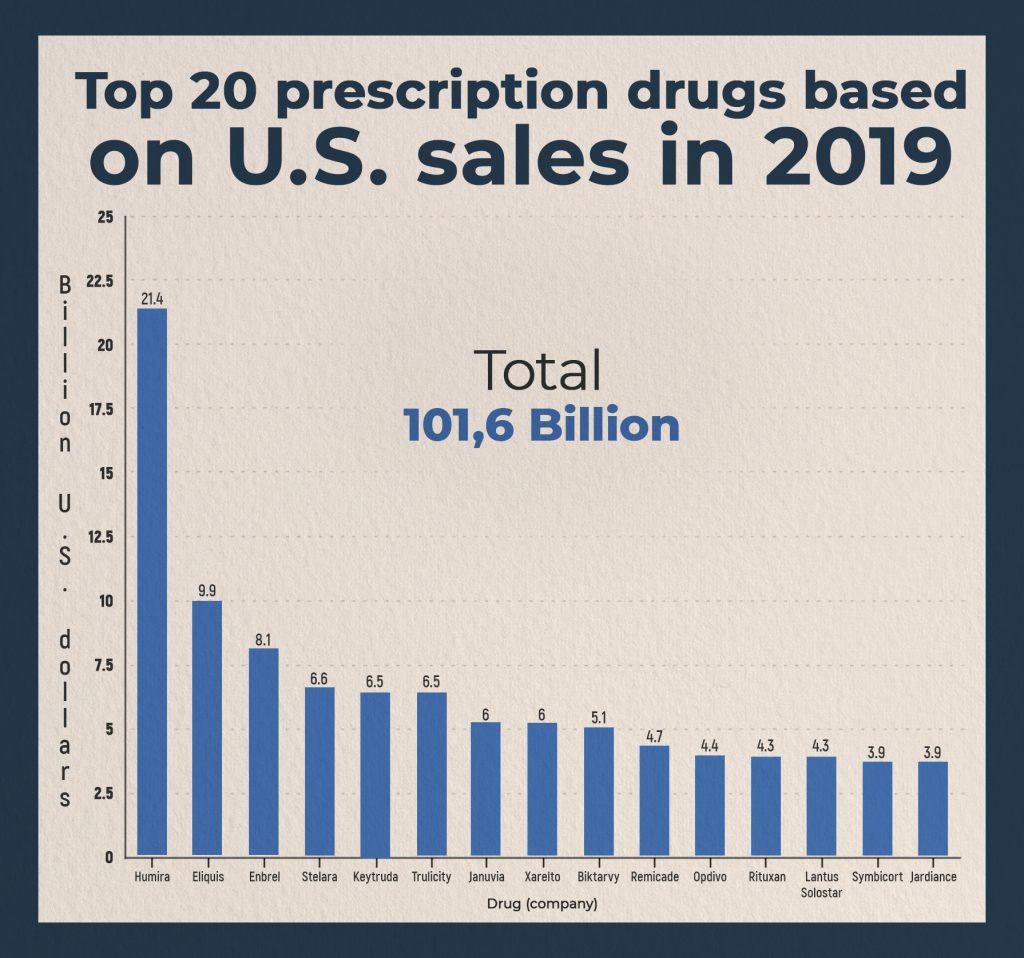

The most “profitable” in the difficult for everyone 2019 was the popular medicine for the treatment of arthritis under the trade name Humira. Americans spent a total of $21.5 billion on it. Medicines for chronic diseases are always the leaders in terms of costs among the population. Diseases such as arthritis, which have a detrimental effect on the quality of life, force patients to spend literally fortunes in an effort, if not to be cured, then at least to achieve a more or less stable remission. Arthritis is a painful disease of the joints, accompanied by severe pain, which needs constant monitoring in order to achieve an acceptable quality of life. Humira, a branded immunosuppressant drug used in the treatment of arthritis, has been at the top of the list of most sought-after drugs in terms of the amount of money patients spend on it for several years. The amount Americans spent on it in 2019 is more than $11 billion ahead of the next highest-grossing drug.

It should be noted, however, that US household spending on Humira more than doubled between 2014 and 2018. These numbers are alarming because there have been no breakthroughs in arthritis diagnostics during this time, which means that the increase in sales of this drug was not due to an improvement in the rate of diagnosis of the disease, but to an increase in the number of cases of arthritis. Most scientists attribute the increase in the number of patients with arthritis and other autoimmune diseases of the musculoskeletal system primarily to the weakening of the population’s immunity and the progressive decrease in motor activity of the average Americans.

US biopharmaceutical company AbbVie, responsible for the production of Humira, had net revenues of approximately $33 billion in 2019. Humira, Imbruvica (a treatment for malignant lymphomas) and Mavyret (a chronic hepatitis C drug) were among AbbVie's top 3 highest-grossing products in 2018. Their sales brought the company about 80% of its total revenue, with Humira accounting for about 57%.

Price Formation Problems

All issues relating to medicine in principle and medicines in particular are always very acute in the United States and attract great public attention. Prices for medicines, especially those for common and chronic diseases, are discussed much more heatedly than in any other developed country, and are even a traditional object of public attention during presidential races. This is not surprising, since pharmaceutical companies in the US generate almost half of the world's pharmaceutical industry revenues, and this is mainly due to high drug prices, not due to their quantity.

In the US, drug pricing is very problematic. Not one reason, but a number of factors contribute to the fact that the United States acts as a country that provides an almost inexhaustible flow of profits for the pharmaceutical industry.

First of all, the reason why prices for patented brand-name drugs in the United States reach very high levels, often several times higher than in other countries of comparable income levels, is the lack of fully integrated universal health insurance. For example, in the US per capita spending on pharmaceuticals is about $1,400 per year, while in neighboring Canada it is well below $900. Among peers, the US is also the country with the highest annual increase in drug prices. This is due to the fact that while the governments of Canada or the UK are negotiating with pharmaceutical players to reduce prices or simply completely refuse to introduce too expensive drugs into circulation, drug manufacturers in the US are negotiating more or less directly with the pharmaceutical market. The consequence of this is that brand drug prices in the US are at the highest possible level. Periodically, there are fears that the market will not withstand such arbitrariness of drug magnates. The great power of the big US pharmaceutical companies, the so-called "Big Pharma", has already become the talk of the town.

A serious factor adversely affecting the situation with drug pricing in the United States is precisely the insufficient level of government involvement in price regulation mechanisms. Although the vast majority of the public and some politicians insist that the government should have more negotiating power, adequate legislation has not yet been passed by Congress.

In addition, oddly enough, another factor contributing to high drug prices in the US is the status of the US as the world center of medical science. The US is home to leading pharmaceutical and biotech companies. Even many foreign pharmaceutical companies choose to conduct their core business in the United States. There is a very high level of investment in research and development, and most of the key research is done in the US, even if it is carried out by European or Asian companies. As a result, end users in the United States are gaining access to new drugs faster than people in other countries, and their range is much wider than abroad. A logical consequence of such exclusivity is high prices for medicines and biologics.

The fact that American pharmaceutical companies conduct most of the promising research and develop advanced drugs against a variety of diseases is, of course, an indisputable achievement of the United States and a big plus for the country's reputation and prestige. However, costly and extensive laboratory and clinical research, as well as huge R&D costs to develop new drugs, hit the pockets of ordinary Americans hard. It should not be forgotten that the cost of any proven effective drug also includes the cost of failures that preceded the creation of itself or other drugs. Statistics show that American pharmaceutical companies spend between two and three billion dollars a year on research and development of new medicines.

On the one hand, the argument that the cost of drugs is affected by the cumbersome, lengthy, and expensive development process seems more than reasonable. One has only to imagine what high-quality and advanced equipment is needed for pharmaceutical research and discovery. Naturally, even the US market – the strongest economy in the world – is able to bear such costs only if the selling price for medicines for end users is high. On the other hand, critics of the US pharmaceutical market rightly argue that the costs of research and development are deliberately exaggerated by representatives of pharmaceutical companies, but in fact much more money is spent, for example, on administration and marketing. The success of the vast majority of drugs against diseases that do not directly threaten the lives of patients is the merit of the competent work of marketers and advertisers, which is paid at the highest rates.

Data on what Americans really think about the current drug price situation varies greatly. One thing that is common among various statistical studies is that approximately 34% of American adults take at least one prescription drug. While some survey data show that approximately 70% of these consumers can afford these drugs without breaking their budget, other surveys make it clear that for approximately 82% of Americans, the cost of prescription drugs is unreasonably high and seriously hurts their income.

It is logical that such a strong difference in survey results indicates a non-universal sample. More optimistic results are shown by respondents with a high or at least an average level of income, residents of large cities with their own housing, higher education and work in their specialty, not burdened by a family. More seriously, the purchase of high-price medicines affects people who whom it was prescribed to take several medicines at the same time, suffering from serious chronic diseases, as well as those with relatively low or low incomes.

The situation with high prices for medicines is threatening to the health of the nation. For example, almost 26% of those surveyed who were prescribed certain prescription drugs said they could not afford to buy them and receive the necessary treatment because of the too high price. The vast majority of Americans, regardless of their income level, are of the opinion that current drug prices are too high. In addition, these prices are by no means constant, they are steadily rising. The annual growth rate of medicine prices has increased especially sharply since 2019, which was marked by the onset of the COVID-19 pandemic and the worsening of the global financial crisis. Data for 2019-2020 shows that about half of all drugs covered by the national health insurance program for people over 65 - Medicare - showed price increases above the rate of inflation. Under Medicare (Part D drug coverage), 23 of the 25 most expensive drugs cost more than inflation.

Are Generics the Solution?

Today in American society there is a serious request to reduce the annual increase in prices for medicines, as well as to link it, as a maximum, to the level of inflation. There is also a request to facilitate the introduction of generic branded drugs to the pharmaceutical market, which will become available to a wider population.

Generics are analogues of branded drugs, their full-fledged substitutes with the same active ingredients and their dosage. They are safe and effective, have the same indications and contraindications for use as their prototypes. Their widespread introduction to the pharmaceutical market helps to reduce the cost of many drugs, make them available to a significantly larger number of patients and, consequently, reduce the national level of spending on drugs and dietary supplements. However, the US generic drug policy is one of the toughest in the world. Large manufacturers of branded drugs have various levers of pressure on the market, which they skillfully use in order to delay the entry of generics of high-priced drugs into the market as long as possible. Sounds insidious? It’s sad, but that’s how it is. One of Big Pharma's main levers of pressure on generic manufacturers is the so-called delay payments – an unscrupulous scheme in which the manufacturer of a branded drug offers a cash reward to the manufacturer of a generic drug if he doesn’t try to enter the pharmaceutical market with his corresponding generic.

It seems that patent holders would go broke in such a scheme, but no, it is more profitable for them than being forced to reduce the price of their original drugs by about half after the appearance of the first generic. If there are several generics of a drug on the market, the price of a branded drug can drop even by 70% of the original cost. Thus, on one side of the scale are the interests of the patent owner, and on the other, the interests of patients, who tend to prefer generics more and more often.

Top Medicines in the US in 2019: the Comparison

Let’s compare data from two sources for 2019 (statista.com an pharmacychecker.com) and try to answer the question: which drugs brought the most income to their manufacturers and were the most popular.

For example, according to statista.com, Januvia, a hypoglycemic drug for the treatment of diabetes mellitus, occupies the 7th position in the top 20 with the amount of $6 billion that Americans spent on it in a year. Meanwhile, according to pharmacychecker.com, Januvia is in a similar list at only 16th position. Janumet, another anti-diabetes drug, ranks 15th on the pharmacychecker.com list, and not on the statista.com list at all. Symbicort, an asthma drug, ranks 14th on the statista.com list with a figure of $3.9 billion for the year, and only 30th according to pharmacychecker.com.

According to pharmacychecker.com, the most popular drugs are Advair Diskus, Synthroid, Domperidone, Ventolin Inhaler. In the list of statista.com they are absent at all.

Even a brief comparison of data from pharmacychecker.com and statista.com shows that there are serious discrepancies between their indicators. This is most likely due to the fact that pharmacychecker.com provides a list of the most popular drugs in terms of sales in online pharmacies, where generics account for a large proportion of the assortment, while statista.com is based on branded drug indicators. However, some medicines made it to the list of both sites, such as Xarelto, Januvia, Janumet, and Symbicort. Those medicines that appeared on both lists are actively bought both online and offline, while pharmacychecker.com data refers more to online pharmacies. Accordingly, the information provided by statista.com is more relevant for medicines that are bought mainly in regular offline pharmacies.

What about the Future?

The third decade of the twenty-first century has arrived. The world is changing rapidly, moreover, it has already changed, even if some people have not yet noticed or realized this. The critical year 2019 with the coronavirus pandemic also served as a powerful impetus for change. The transition of all trade sectors to online has gained momentum, and the pharmaceutical industry is no exception. Already in 2019, there was a sharp increase in the popularity of online pharmacies compared to 2018. More and more Americans are turning their attention not to branded drugs, but to their generics, and tend to purchase them in online pharmacies. Accordingly, most likely, in the near future, most popular drugs will be available for purchasing online. More and more generic drug manufacturers will offer their products in convenient online pharmacies, and brand drug manufacturers will also try to retain their “audience” by developing online shopping spaces. Online drug trade is definitely the future – not only of the US, but of the whole world.